Intelligent Software for a More Efficient Grid

DVI’s smart voltage optimization delivers energy savings and precise control for managing fluctuating voltages on the grid.

About DVI

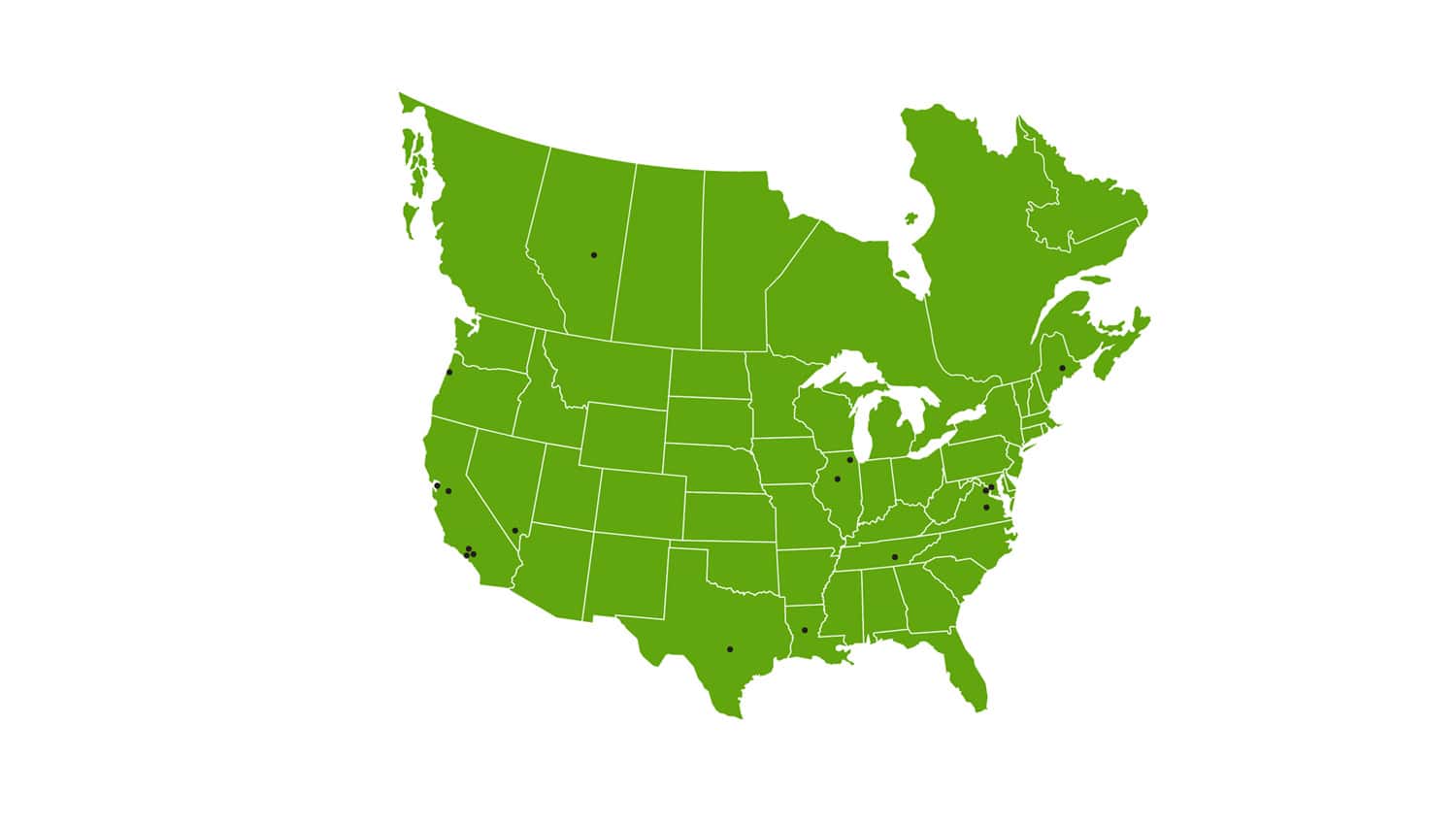

A subsidiary of Dominion Energy, DVI (Dominion Voltage Inc) is the industry leader for demand response, energy efficiency (CVR), renewables integration, and emergency voltage reduction. EDGE® software by DVI delivers significant savings to electric utilities and their customers. And since it was developed by a utility company for utility companies, EDGE® provides superior voltage control and better visibility, even with increasing penetration of DERs. EDGE® maximizes:

• Peak reduction

• Energy efficiency and savings

• DER stability control

• Emergency Voltage Response capabilities

EDGE® in Action

The EDGE platform enables distribution grid operators to meet their most demanding goals. Understand what challenges can be conquered with the DVI solution:

Energy Efficiency

If you are trying to meet energy efficiency goals or offset the development of new baseload generating facilities, our energy efficiency and grid-optimization solution provides up to 4% energy savings to all customers without the need for costly engagement programs and customer purchases. Leveraging the latest in smart metering, our conservation voltage reduction solutions monitor voltages down to the customer level, responding dynamically to customer demands.

Makes the Business Case For AMI

Reducing energy costs makes the business case for Advanced Metering Infrastructure. EDGE® uses customer voltage information to safely reduce energy usage by as much as 4% annually.

Helps Meet Energy Efficiency Goals

Roughly 95% of the savings generated by CVR are in the customer’s home. This makes EDGE® one of the most cost-effective, customer-focused, nondiscriminatory energy efficiency programs in the market, delivering savings you can rely upon year after year.

Helps Reduce Emissions

When operating 24/7, the energy savings from EDGE® reduces baseload generation needs by targeting coal-fired generation and offsetting carbon emissions.

Demand Reduction

If you are trying to avoid costly peak demand charges or the development of new peaking facilities, our energy distribution and grid-efficiency solutions can shave customer peak by as much as 4% without the use of in-home control devices and opt-in/opt-out programs. Using the latest in smart metering, our demand voltage response solution allows you to dial in your demand savings while maintaining service reliability.

Safely Reduces System Peak

Reducing peak demand is a way to save both the utility and the customer money. The real-time visibility of customer voltages provided by EDGE® allows you to maximize your savings without pushing risk to your customers.

Provides Spinning Reserve

Voltage Reduction can be used to reduce capacity constraints during extreme peak conditions. EDGE® can be used to alleviate capacity issues during curtailment events while providing day-to-day visibility into circuit performance.

Compliments Existing Load Control Programs

EDGE® responds to changes in customer voltages due to direct load control programs. The customer-focused approach of EDGE® allows you to combine your Voltage Optimization and Direct Load Control programs, meaning more savings for you and your customers.

DER Management

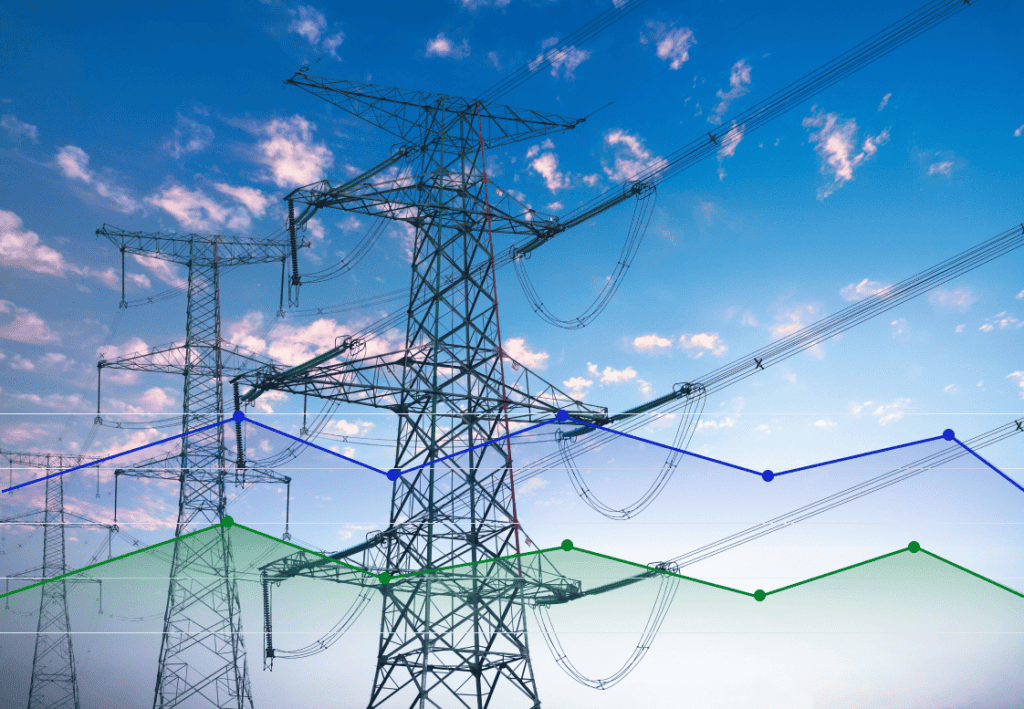

DVI’s EDGE® software provides grid stabilization and voltage management for areas with large amounts of distributed generation and highly variable loads such as electric vehicles.

Reliability During Uncertainty

Unprecedented change and an influx of new renewables is causing concern for stability on the grid. Utilities need a reliable software solution to monitor and manage voltage volatility.

Staying Ahead

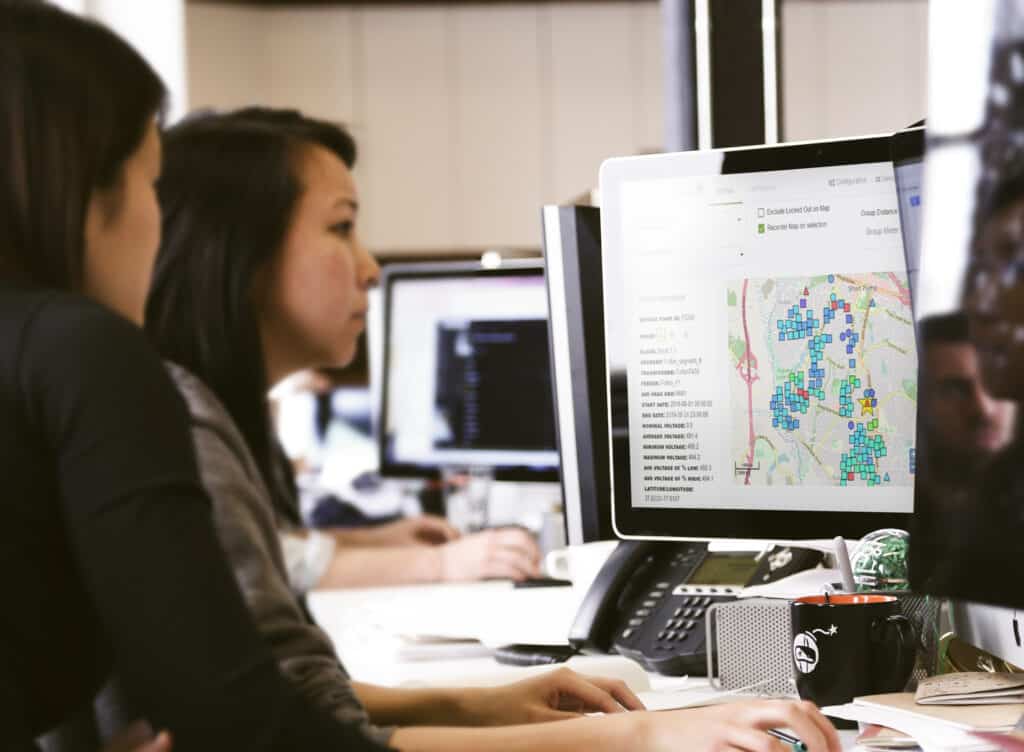

To Manage the grid, you need to know what is happening and look forward in time to predict what is likely to change.

Ongoing Monitoring

EDGE Stabilizer monitors AMI every 15 minutes, watching your highest and lowest meters to make sure your voltage doesn’t go too high or too low when intermittent renewables swing the distribution voltage.

Grid Resiliency

For years, voltage reduction has been a first step to avoid blackouts, but the effort has been diminished from a lack of real-time information. With AMI-informed voltage control, there is a precise and powerful option that is far superior to blackouts.

Rotating blackouts are becoming a more common occurrence due to the increased number and strength of extreme weather events.

Informed Emergency Operations

EDGE®’s EVR EDGE calculates the available demand reserve per circuit, keeping ADMS/SCADA operators informed during an emergency reduction scenario.

Precise Control

EDGE® possesses comprehensive visibility into the distribution circuit through AMI voltage data and can precisely calculate the optimal amount of voltage reduction for each circuit. This allows utilities to maximize the load reduction during an emergency while ensuring that customers remain within the acceptable voltage limits specified by the ANSI standard. EDGE® technology also offers selectivity in case any sensitive circuits need to be excluded from the EVR operations.

Rapid Emergency Response

EDGE® EVR technology rapidly and accurately lowers grid voltages to emergency target recommendations. During EVR operations, EDGE® initiates an immediate voltage drop and then continues to monitor customer voltages. It will continue to recommend voltage setpoints to maintain the lowest allowable customer voltages, achieving minimum reliable voltage and maximum load reduction. EVR can be deployed to any or all circuits under EDGE® control, with the click of a button.